In the tech startup sphere, advisory shares are a double-edged sword. They're an interplay of equity, wisdom, trust, and strategy, potentially leading you to peaks or pitfalls.

Deciding who to entrust with these shares, how to correctly allocate compensation, and where to distinguish them from regular equity - these are critical questions for early-stage founders.

Let's venture into the realm of startup advisory shares, addressing the whys, whos, and hows - a key to an enlightened entrepreneurial path.

Table of Contents

What are advisory shares?

Advisory shares, also known as “advisor shares”, are a type of stock given to company advisors instead of employees. In other words they are financial rewards provided to advisors in the form of stock options (technically speaking, advisory shares are stock options given in exchange for expertise while regular shares are stock units sold on the open market). This is usually done at the “we really respect your time, expertise, and network but lack the funds to adequately compensate you” stage of the company (although more mature companies may also bring on advisors depending on the industry).

Advisory shares, also known as “advisor shares,” are a type of stock granted to company advisors instead of employees. They serve as financial rewards provided to advisors in the form of stock options. Technically speaking, advisory shares are stock options exchanged for expertise, while regular shares are stock units sold on the open market. This practice typically occurs when startups say, "We respect your time, expertise, and network, but we lack the funds to compensate you adequately," though more mature companies may also engage advisors depending on the industry.

Why is this the case?

Startups traditionally face limitations, particularly regarding available capital to properly compensate advisors. Advisory shares allow a startup, especially in its early stages, to offer a non-cash stock option in exchange for the advisor’s expertise and time. This strategy enables the startup to allocate its limited capital to other critical areas.

Furthermore, advisory shares provide an incentive for advisors to remain with the company over the long term. Rather than a simple one-time cash exchange, advisory shares are appealing to advisors because they link their earning potential to the company's long-term success.

Types of advisory shares

Restricted Stock Awards (RSA)

Restricted Stock Awards (RSA) are shares given to advisors that come with certain restrictions, such as vesting periods or performance milestones. These shares often require advisors to remain with the company for a specified time before they can fully own or sell the shares, creating a strong incentive for continued involvement and support. RSAs can also be beneficial for startups because they reduce the risk of immediate dilution of ownership and can align the advisor's interests with the company's long-term goals, making them a preferred choice for early-stage companies seeking strategic guidance.

Stock Options

Stock options provide advisors with the right to purchase shares at a predetermined price, known as the exercise or strike price, within a specified timeframe. This arrangement can motivate advisors to actively contribute to the company's growth, as the potential for profit increases if the company's stock value rises above the exercise price. Unlike RSAs, stock options do not confer ownership until exercised, allowing startups to manage their equity distribution strategically. Additionally, stock options can offer tax advantages for both the company and the advisor, depending on how and when they are exercised.

Who are the advisors?

The advisors given advisory shares are usually business professionals who are former founders or senior executives in the same operating industry as the startup. The advisors provide insight and connections in exchange for equity in the startup.

Like anything startup related, founders need to exercise caution. They need to be careful of who they approach to be an advisor. Not everyone can provide the value that they may claim to have. In the best case scenario, an advisor can open doors and be a boon to the startup, positioning it for success. In the worst case scenario, they can be a waste of time and even a liability.

It should be noted that accountants, attorneys, and other professionals receive cash compensation for their services and are usually not advisors. This is especially the case if you don’t have a pre-existing relationship and are just looking to cut costs.

The right advisors are the people who can shore up a weakness that the founder or startup may have. Here are a few types of advisors to keep in mind.

- The big name. This is often someone who is widely known in not only the startup community, but in other areas as well. Their social media is full of articles featuring them, podcast appearances, speaking engagements. Having them involved can raise the startup’s profile and open doors.

- The founder with multiple exits. This is the founder who has been through the ups and downs of the startup game, and lived to tell the tale. They have grinded (or been grinded depending on your perspective) the startup scene multiple times and now spend their time advising, investing, and strategically connecting the companies they are involved with.

- The niche expert. This advisor is one who comes from a specific niche or industry and can provide tailored advice. For example, if you have a startup in the future of work space, then an advisor with decades of HR experience across Fortune 100 companies and startups would be a key asset.

- The thought generator. This is a practical businessperson who can brainstorm with the founders and break down ideas, risks, and the general strategy of the company.

How do you know which advisor should get which compensation?

Roughly speaking, no more than 5% of a company’s total equity should be allocated to advisors - and it can be much less. A company can also form an advisory board to help with this. Individual advisors can be compensated depending upon their contribution to the startup. An advisor who serves as a pipeline for new customers may receive a larger percentage than an advisor who simply provides a monthly ideation phone call.

It also depends on the stage of the company. That early stage pre-seed company may provide more equity to an advisor than a Series A company would for an advisor doing the same amount of work. Simply put, it is easier to part with 1% of a company that has no real valuation than a company valued at $10 million or more.

Founders need to realize that advisors could also be working with multiple companies and this may include rival organizations. Advisors need to be able to provide impartial advice so founders need to know who they are going to be working with and more importantly, who they can trust.

We often hear about product-market fit but very little on founder-advisor fit. This is often the result of multiple meetings and conversations rather than a simple DM or email.

Finding the right advisors is a time-consuming process. It may take a bit but could prove beneficial, especially if the fit proves to be correct. As advisors have a unique perspective on the company, it isn’t uncommon for many to become employees or even future investors.

What are typical terms for advisory shares?

The terms for advisory shares can differ depending on who you ask.

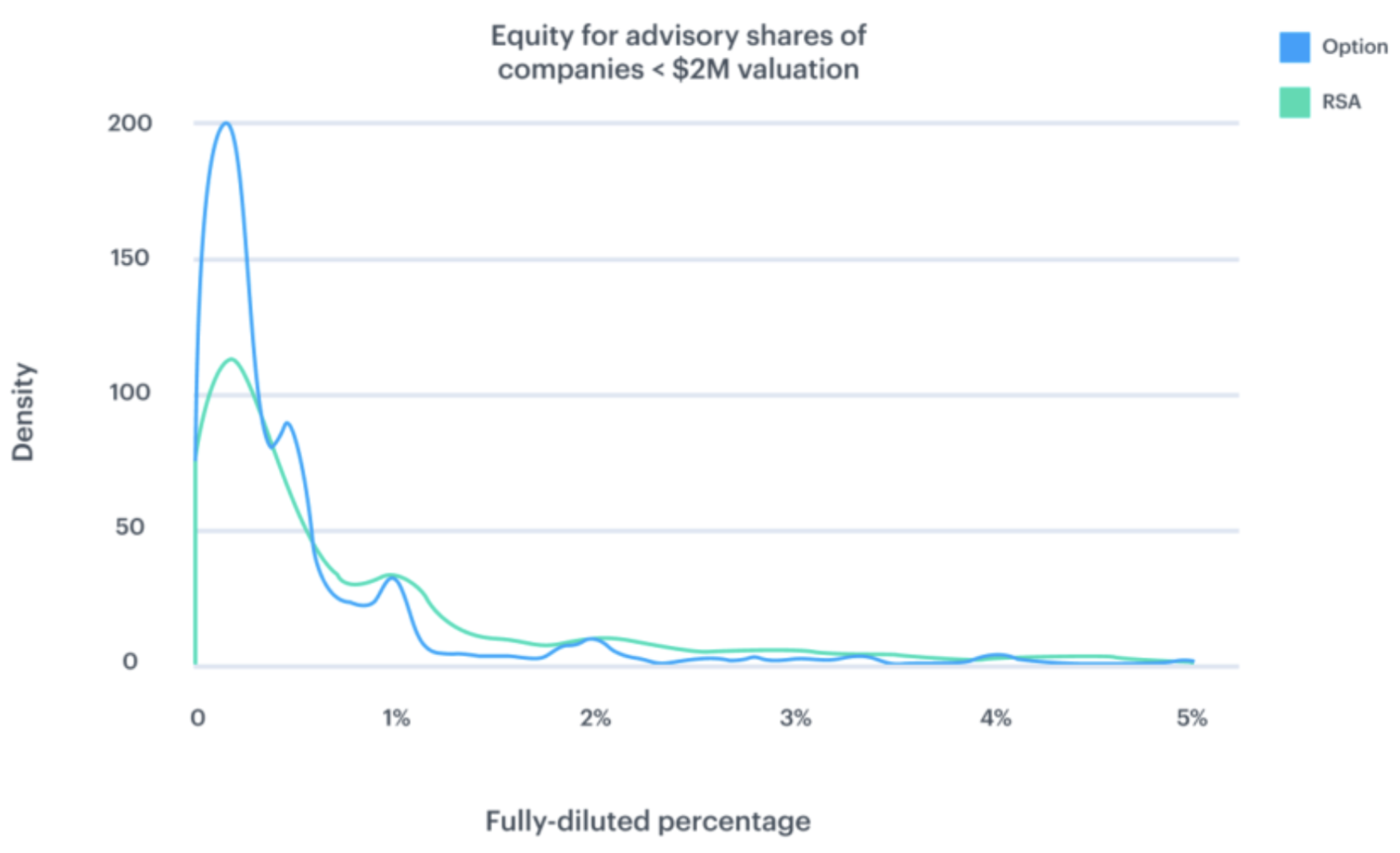

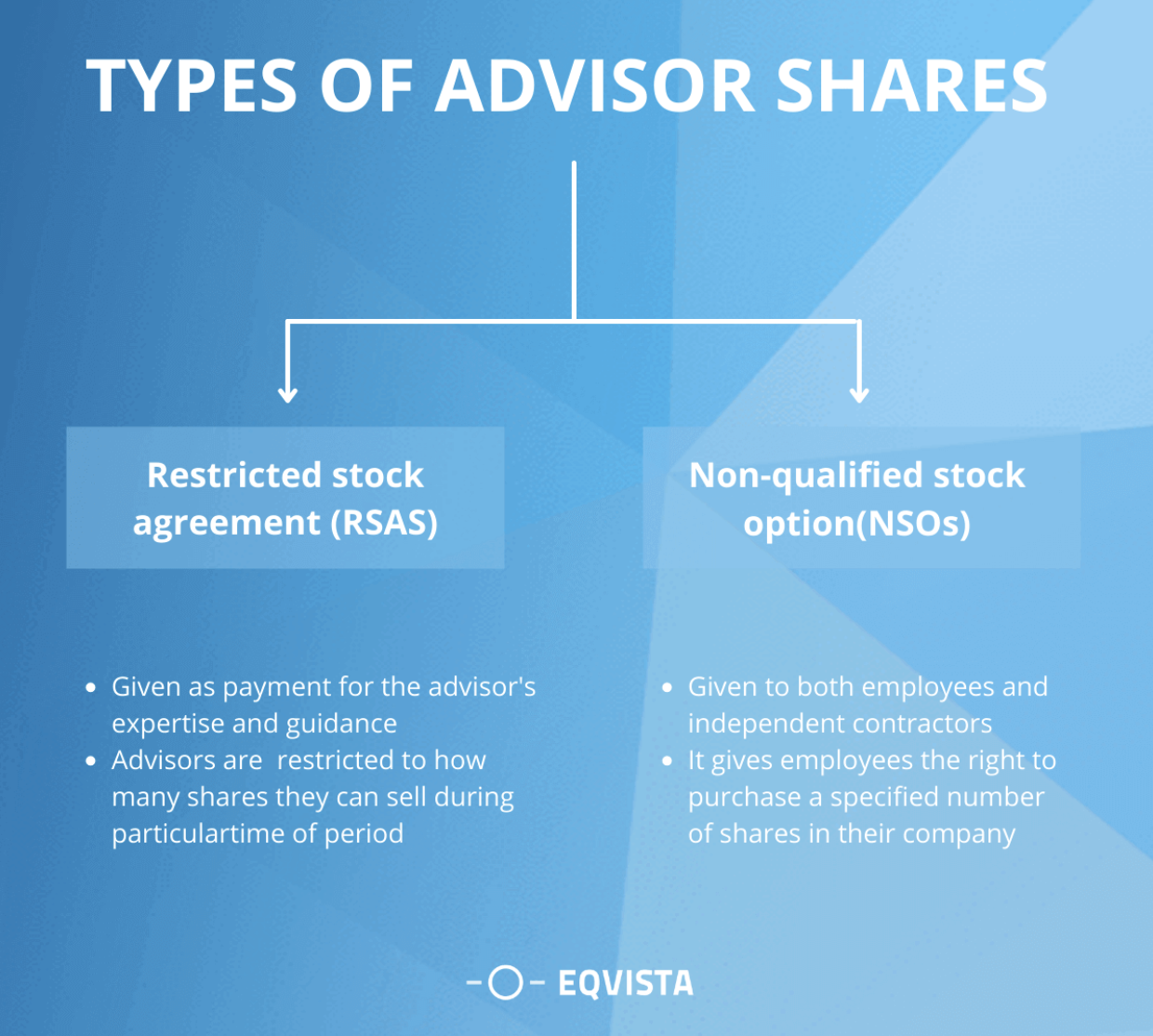

Carta provides this graph and insights for advisor shares issued in 2019 for companies that raised under $2 million. Their information is based on RSAs (restricted stock award in which shares are bought upfront) and NSOs (non-qualified stock options to buy shares which are awarded later on). Advisor RSAs receive 0.2-1% of a company while advisor NSOs receive 0.1-0.5% of a company.

According to Y Combinator partner Eric Migicovsky, a common set up is granting 0.25% to 0.75% of equity to the advisor - with a monthly vesting over 2 years.

It should also be noted that RSAs are larger because they are issued after incorporation but before there is an increase in the fair market value of a company. EQVISTA breaks it down further with this easy to use infographic.

What is a vesting schedule?

Some advisory agreements also call for a trial period - say 2 or 3 months - where the deal can be terminated with no options being transferred to the advisor.

Keep in mind that advisors are not forever. You might need a product-oriented advisor at early-stage, and a more strategic advisor at later-stage. Your rooster of advisors will evolve over time, hence the 2-year vesting.

Best Practices for Advisory Vesting Schedules

- Monthly Vesting: One of the most common practices is to implement monthly vesting over a standard period, such as 1 to 4 years. This approach ensures that advisors receive their shares incrementally, which can encourage ongoing engagement and support for the company. Monthly vesting is especially useful for early-stage startups, where advisors are expected to provide continuous assistance over time.

- Milestone-Based Vesting: For startups looking to tie the advisor's compensation to specific achievements, milestone-based vesting can be highly effective. This structure allows shares to vest upon reaching particular goals (e.g., securing funding, achieving revenue targets, or launching a product). Milestone vesting can incentivize advisors to leverage their networks and expertise actively.

- Cliff Periods: Including a cliff period (typically 6 to 12 months) is advisable, meaning that no shares vest until the cliff is reached. This setup can help ensure that advisors are genuinely committed to the company before they start receiving equity. If they leave before the cliff period ends, they receive no shares, which can protect the startup's equity pool.

- Flexibility: Consider the unique circumstances of each advisor. Some may prefer a more accelerated vesting schedule, while others might be comfortable with a longer-term approach. Open communication about expectations can lead to a structure that benefits both parties.

Advisor shares vs. normal equity

If you are going to be an advisor, you need to know the difference between advisor shares and equity. Here is a list to help you keep it in check.

- Advisory shares are provided in exchange for your guidance. Unlike normal equity shares which are issued in exchange for money, your shares are exchanged for your services.

- Advisor shares are restricted to a certain amount of shares and/or time. Normal shares are sold on the market.

- Normal shares can be owned by anyone. An employee of the company may receive them as part of a compensation plan or someone with a Robinhood account may purchase them. Advisory shares are only owned by the people who receive them in exchange for their services and expertise.

- Normal shareholders can profit from the success and the failure of the company. Advisory shareholders let the company find some measure of success before they can profit from their own stock options.

Pros and cons of advisory shares

Pros of Advisory Shares

- Cost-Effective Compensation: Advisory shares allow startups to compensate advisors without cash, preserving funds for critical business needs.

- Alignment of Interests: Equity compensation ensures that advisors have a vested interest in the company’s success, motivating them to provide valuable guidance.

- Access to Expertise: Offering advisory shares can attract high-quality advisors who bring essential industry knowledge, networks, and credibility to the startup.

- Vesting Incentives: Many advisory shares have vesting schedules, encouraging advisors to stay engaged and supportive over time.

Cons of Advisory Shares

- Potential Dilution: Issuing advisory shares can dilute the ownership percentage of existing shareholders, which can be a concern for founders and investors.

- Complexity in Structuring: Setting up advisory shares requires careful legal and financial planning, which can be complex and resource-intensive.

- Tax Implications: Advisors may face complicated tax situations, depending on the nature of their shares and when they exercise options, adding an additional layer of complexity.

How do I manage my advisors and their shares?

So you are the founder of the next Facebook but for insects and have some great advisors on board. Now you need to know how to manage their advisory shares as well as provide them with the proper documentation.

- Check out the FAST agreement. The Founder Institute FAST (founder advisor standard template) is used by tens of thousands of founders and advisors around the world.

- Check out Cabal. Cabal is an app that allows founders to make introductions, track contributions, and connect top talent. More importantly, it makes it simple to program your equity to incentivize advisors. It also has a leaderboard to show which advisors (and even investors) have contributed the most help to the company.

- Check out Fairmint. Fairmint empowers founders to grant equity to their community in exchange for time or money they invest. This is not only great for advisors but also allows everyone from contractors to influencers to be rewarded in tokenized equity for their time, contributions, or money.

- Do you know other tools to manage your advisors? Email us at [email protected] and we'll make sure to update the list

One last word of caution

Talk is cheap. If you're a first-time founder, you might be impressed by a supposedly "big shot" business guy who claims to have all the answers and know all the right people. And he will help you in exchange for equity.

As with everything, exercise caution. Do a trial period, run a background check, and make sure this person will actually bring value.

Few things are worse than a backseat driver.

Conclusion

Founders can’t know everything (and the ones that claim they do should be avoided at all costs). It is essential for founders to seek out the wise and offer them advisory shares. But it is just as essential for advisors to know how these shares work and how they can benefit. After all, when it works out, it is a win-win for everyone involved.

Find ideal VCs for your startup today 🚀